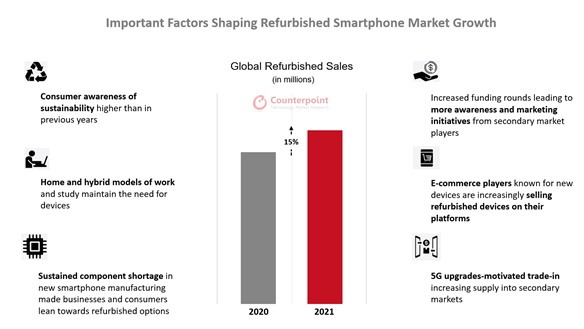

The global secondary smartphone market saw a surge in demand as well as supply in 2021. Even as new smartphone shipments grew 4.5% YoY in 2021, refurbished smartphone volumes witnessed a 15% YoY growth. With new flagship smartphone prices remaining at the higher end, a larger share of consumers considered buying refurbished models of popular brands like Apple and Samsung.

As sustainability garnered more interest, consumers were exposed to more benefits of choosing a pre-owned device. Customer awareness of refurbished smartphones, certified pre-owned alternatives, quality checks in the secondary markets and warranty options increased during the year. Refurbished players too have matured since 2018 and are now scaling up for more volumes. Apple remains the secondary smartphone market leader but the dynamics between brands seem to be shifting as well.

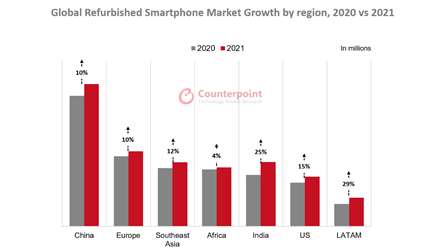

Commenting on the growth in pre-owned and refurbished volumes, Senior Analyst Glen Cardoza said, “Refurbished smartphones are a part of overall pre-owned devices which re-enter the system through various routes. Trade-ins are the fastest-growing source for such pre-owned smartphones, the volume of which grew more than 10% globally in 2021. We are seeing a YoY increase in volumes among refurbished players in developing markets like China, India, Latin America, Southeast Asia and Africa. These markets will grow more as they have many unorganized businesses and a large rural demographic yet to be captured. ASPs (average selling prices) of refurbished smartphones increased marginally as 4G devices still retained value.”

Latin America and India lead with the highest growth rates, at 29% and 25% respectively. Even the US, China and Europe regions have shown a strong growth in volumes from 2020. Research Director Jeff Fieldhack said, “The India and LATAM markets saw the highest growth rates in 2021 and also have the highest future potential growth over the next few years. There were supply shortages in the secondary market in 2020 due to COVID-19 lockdowns and other supply chain disruptions. But the market roared back in 2021. There are large consumer appetites for flagships and the latest flagships have the highest point-of-sale prices in India and LATAM. The secondary market offers consumers the ability to access these devices at ASPs 60% lower than new versions. The improved durability and high quality of flagships make them very appealing in the secondary market”

Fieldhack added, “The US and EU secondary markets bounced back in 2021. In the US, new Apple and Samsung flagship sales increased, which in turn increased the volumes of collected devices at carriers and other collection channels. On the consumption side, amid increasing insurance attach rates, the use of CPO (certified pre-owned) devices as insurance replacements increased during 2021. The B2B consumption of used devices also increased. In the EU, government initiatives are helping secondary market sales. Carriers are also making efforts to use more secondary market devices with e-waste reduction goals. Finally, EU marketplaces and collection companies – Back Market and EcoATM being examples – are growing their presence.”

There is a renewed focus on value chain activities like Repair. This is comparatively more prevalent in mature markets like the US, Europe and Japan. Due to the momentum gathered by the ‘Right to Repair’ movement, there are many new players that have entered these markets seeing a whole new potential once governments and consumer bodies advocate this movement further. Refurbished players in mature and developing markets perceive repair differently as a value-add activity in the chain.

Eco-rating is another sustainability step taken to help consumers make an informed purchase. These initiatives have started in Europe and are gaining support not only with consumers but also with operators and OEMs. However, these initiatives will still take some time to get a foothold even in mature markets. Businesses will continue to prioritize profit generation, which will slow down the pace of these eco-centric initiatives.

Keeping sustainability in mind, some OEMs have started advertising and assuring all stakeholders about their sustainable practices, right from sourcing and production to the end of device lifecycle. This is an ongoing set of initiatives that will gather more steam in the coming quarters. OEMs will have to balance the cost of sustainability with their profit.

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.