India electric vehicle market size to hit USD 113.99 billion by 2029 at a CAGR of 66.52% during the forecast period. The market is growing incredibly well due to the adoption of electric micro-mobility vehicles worldwide. Fortune Business Insights stated this in a report titled, “India electric vehicle Market, 2022-2029.”

The market was valued USD 1.45 billion in 2021, and USD 3.21 billion in 2022 respectively. The growth of the electric vehicle (EV) market in India is being fuelled by several key factors, including government support, heightened environmental awareness, and technological advancements. The Indian government has taken steps to promote EV adoption, offering tax breaks and subsidies for consumers, as well as investing in the development of charging infrastructure.

As individuals become more conscious of the environmental impact of traditional fossil fuel-powered vehicles, EVs are becoming increasingly popular as a more sustainable and eco-friendly alternative. Advancements in battery technology and the availability of convenient charging options have further boosted the appeal of EVs.

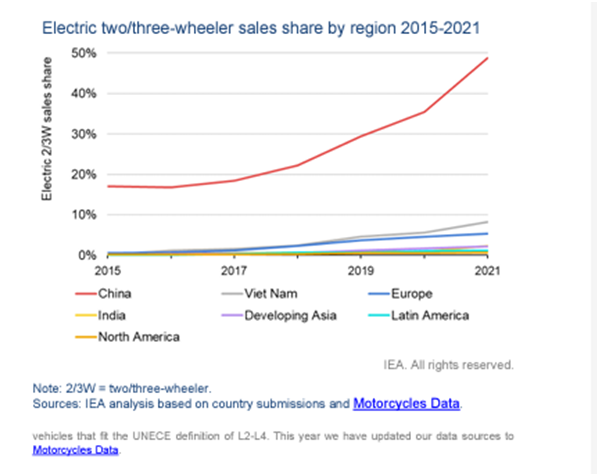

Several companies that entered the two/three-wheeler market focussing only on electric models are now large companies that sell their vehicles worldwide, such as Niu and Gogoro. This market continues to attract new investment. A notable example is one of the world’s largest electric two/three-wheeler factory being built in India

CourtesyGlobal EV Outlook 2022

India’s light vehicle market grew by 23% in 2022 to 3.8 million units. Initially, electric vehicles (EVs) occupied 1.3% of the Indian market share but the market grew by a phenomenal 223% in 2022 by adding 48,000 EVs.

“The overall sentiment around the auto industry remained strong in India during 2022, propelled by pent-up demand and rising consumer buying power,” said Canalys Automotive Analyst, Ashwin Amberkar. “It is exciting times in the Indian market. New cars have premium infotainment, connectivity and driver assistance features, and there is a good appetite for new technology amongst premium buyers, despite potential economic headwinds.”

“The Indian electric vehicle market is in its nascent stage,” said Amberkar. “Tata leads in EVs with 86% market share from just two models, the Nexon EV and Tigore EV, followed by MG’s ZS EV and Hyundai’s Kona with 9% and 1.6% respectively. The most successful EVs from Tata are under US$20,000 which is the sweet spot among buyers wanting a second, city commute car. Brands such as MG, Hyundai, KIA and BYD are offering premium EVs costing over US$25,000 which predominantly attracts wealthy eco-conscious professionals and EV enthusiasts.”

Luxury brands such as Audi, BMW and Mercedes-Benz sell globally popular EV models in India, but in small volumes. Luxury brands grew by over 34% in 2022, with total vehicle sales reaching 36,000 units. Mercedes-Benz and BMW posted record sales but represented less than 1% of the total market.

The FAME India Phase II government scheme to promote nationwide rapid adoption of EVs through automakers’ incentives will continue to help establish the market until its expiration on 31 March 2024. Canalys forecasts that the EV market in India will grow to over 300,000 units in 2025, representing over a 6% share of the total light car market, achieving a CAGR of 59%.

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.