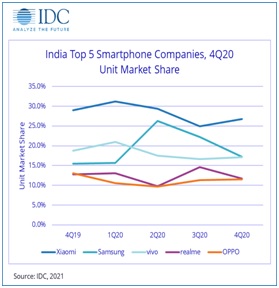

The Indian smartphone market exited 2020 at 150 million units, a 1.7% YoY decline, after several years of growth. Stay-at-home mandates, remote work, remote education, travel restrictions, and manufacturing shutdowns led to a sluggish H1’20 (-26% YoY decline), particularly impacting 2Q20. However, H2’20 recovered, with 19% YoY growth, as markets reopened gradually. Lockdowns and restrictions rendered an urgent need for devices supporting activities such as entertainment, work from home, and remote learning, resulting in more devices per household, and leading to a resurgence in demand for consumer devices including smartphones, consumer notebooks, and tablets in 2020

India’s smartphone market started 2Q21 (April-June) on a low note amidst the second wave of COVID-19 but quickly recovered towards the end of the quarter, witnessing 86% year-over-year (YoY) growth to reach 34 million units. The second wave of COVID-19 hit the country almost a year after the first wave but varied significantly in terms of market response. Infections spread much faster even in rural areas and had a higher mortality rate, but there was a lesser impact on manufacturing and logistics, while the lockdown was not as strict as the year before. As a result, state-led lockdowns resulted in a few pockets recovering faster in the second quarter, generating pent-up demand in June’21.

(with inputs from IDC)

(With inputs from Counterpoint Research)

Key findings of Report

- India’s smartphone market registered its highest ever shipments in H1 2021.

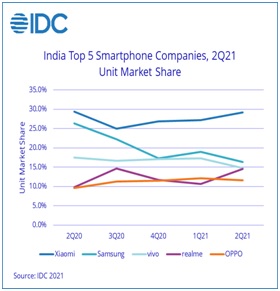

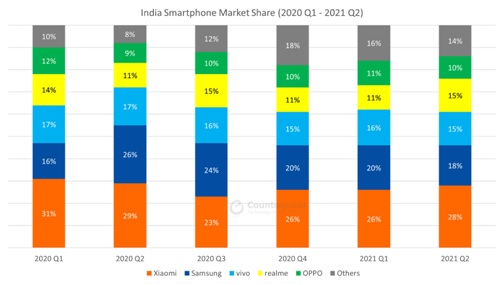

- Xiaomi led the market in Q2 2021 with a 28% shipment share. The brand registered its highest-ever ASP (average selling price) in a single quarter due to the strong performance of the Mi 11 series.

- Samsung captured the second spot with an 18% share while vivo captured the third spot with a 15% share.

- realme became the fastest brand to reach 50 million cumulative smartphone shipments in India.

- OnePlus led the premium market (>INR 30,000) with a 34% share.

Some of the key trends that was witnessed which had triggered the growth are:

- Growth of online channels – The pandemic has led to an accelerated growth of the online channel, led by eTailers, resulted in a record share of 51% with a massive 113% YoY growth. On the flip side, the offline channel was impacted by weekend curfews in many areas and partially opened markets (with odd/even schemes) through May and mid-June.

- India emerged at the fourth position, following PRC, USA, and Japan, in terms of 5G shipments of 5 million with the lowest ASP at US$410. Though the government is yet to roll out the spectrum, IDC expects an inflow of more affordable 5G devices by end-2021 at sub-US$200.

- Demand of 5G smartphones on the rise – 5G smartphones accounted for <3% of the overall market in 2020. Even without the 5G network roll-out, India has already become one of the top markets for shipment of 5G smartphones. As 5G continues to be one of the top desired features in a smartphone, total shipments of 5G smartphones in India is estimated between 32 million and 40 million units in 2021.As per CMR report India continued to see a rise in share of 5G smartphones as such devices accounted for 22 per cent of the market share in the third quarter of 2021.

- Festive season gave rise to strong demand –In the festive season sales, the strong consumer demand for smartphone upgrades has been met by aggressive offers in the value for money and premium smartphone segments from smartphone brands.

Analysis

In our opinion, the constant need to get connected and be in touch with our colleagues and

, the rising income levels has termed smartphones to be a necessity rather than luxury.In addition, fierce competition among handset manufacturers and technological innovations keeps driving down the prices of smartphones, boosting affordability and sales growth.

With faster internet speed, consumption of online entertainment has skyrocketed, YouTube, Netflix, Amazon Prime, and many others offer a host of entertainment options, which can be easily accessed through smartphones.