- Revenue is expected to be between US$19.9 billion and US$20.7 billion;

- Based on the exchange rate assumption of 1 US dollar to 31.5 NT dollars,

- Gross profit margin is expected to be between 59.5% and 61.5%;

- Operating profit margin is expected to be between 49% and 51%.

Taiwan Semiconductor Manufacturing Co., the biggest contract manufacturer of processor chips for smartphones and other products, said Thursday that its quarterly profit rose 79.7% over a year earlier to $8.8 billion amid surging demand.

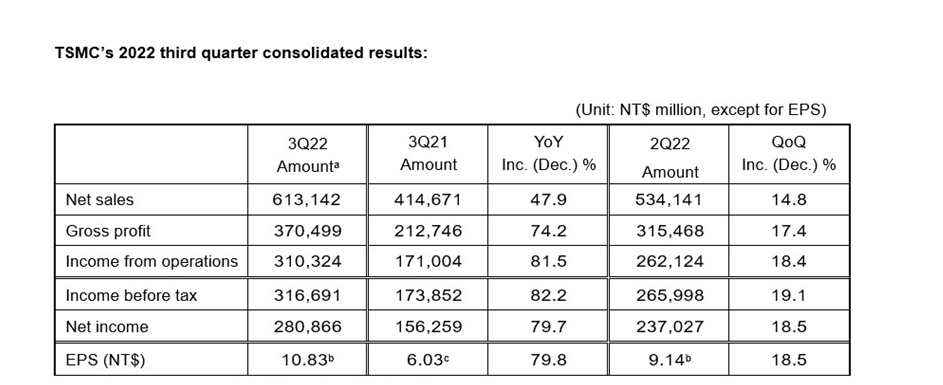

Quarterly revenue rose 47.9% over a year ago to $19.2 billion, the company reported. TSMC announced consolidated revenue of NT$613.14 billion, net income of NT$280.87 billion, and diluted earnings per share of NT$10.83 (US$1.79 per ADR unit) for the third quarter ended September 30, 2022.

Year-over-year, third quarter revenue increased 47.9% while net income increased 79.7% and diluted EPS increased 79.8%. Compared to second quarter 2022, third quarter results represented a 14.8% increase in revenue and a 18.5% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, third quarter revenue was $20.23 billion, which increased 35.9% year-over-year and increased 11.4% from the previous quarter.

Gross margin for the quarter was 60.4%, operating margin was 50.6%, and net profit margin was 45.8%.

In the third quarter, shipments of 5-nanometer accounted for 28% of total wafer revenue; 7-nanometer accounted for 26%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 54% of total wafer revenue.

“Our third quarter business was supported by strong demand for our industry-leading 5nm technologies,” said Wendell Huang, VP and Chief Financial Officer of TSMC. “Moving into fourth quarter 2022, we expect our business to be flattish, as the end market demand weakens, and customers’ ongoing inventory adjustment is balanced by continued ramp-up for our industry-leading 5nm technologies.”

TSMC, headquartered in Hsinchu, Taiwan, makes processor chips for brands including Apple Inc. and Qualcomm Inc. Chipmakers are benefiting for demand for next-generation telecoms, high-performance computing and chips for use in products from cars to medical devices.

TSMC announced plans last year to invest $100 billion over the next three years in manufacturing and research and development. TSMC announced plans last year to build its first chip factory in Japan. The company and Sony Corp. later said they would jointly invest $7 billion in the facility

Most semiconductors used in smartphones, medical equipment, computers and other products are made in Taiwan, South Korea and China. That has prompted concern among American officials about reliance on supplies that might be disrupted by conflict between China and Taiwan. They are lobbying TSMC and other chipmakers to set up factories in the United States.

TSMC operates a semiconductor wafer fabrication facility in Camas, Washington, and design centers in San Jose, California, and Austin, Texas.

The company has announced plans for a second U.S. production site in Arizona.

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.