India’s neckband market shipments declined 9%YoY in 2022, according to the latest research from Counterpoint’s IoT Service. This decline was primarily due to seasonality and rising competition between hearable types. Indian consumers have started preferring Truly Wireless Stereo (TWS) devices over neckbands, especially due to their sleek design, newly added features and affordable prices. However, the demand for neckbands is still strong in the Indian market as many consumers use neckbands as a secondary device that is affordable, ideal for longer usage and suitable for applications like running, workout and travelling.

Commenting on the market trends, Senior Research Analyst Anshika Jain said, “Indian neckbands are expanding towards the low-price tier of <INR 1,000 (or around <$13), which reached its highest ever share of 32% in 2022, up from 20% in 2021. Many brands are focusing on this tier to acquire the wired earphone user base. Over 80 brands entered the neckband market in 2022, reflecting the growth potential of this market. In terms of distribution, online channels contributed nearly three-fourths of total shipments with Flipkart taking the lead followed by Amazon. boAt, OnePlus and Boult Audio were the top-selling brands in the online segment.”

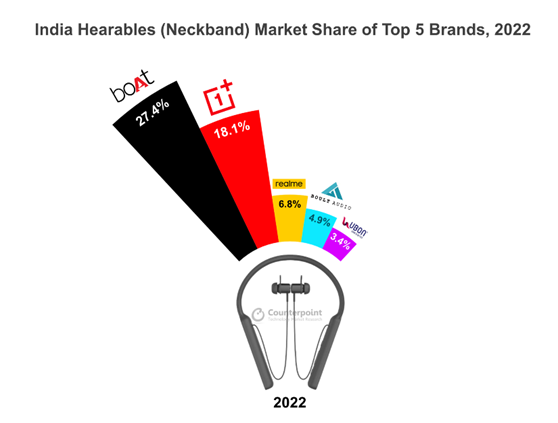

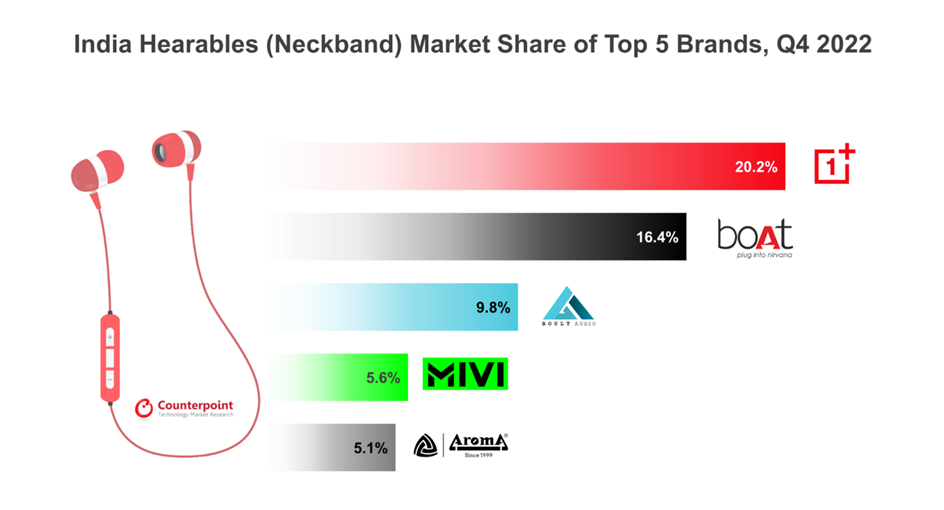

Jain added, “In 2022, the homegrown brands captured seven spots in the list of top 10 brands with boAt taking the top spot. However, the contribution of local brands remained at 62% (showing a slight dip compared to 2021) as Chinese brand OnePlus started gaining prominence with its Bullets Wireless Z2 model. In fact, in Q4 2022, OnePlus became the top player in India’s neckband market for the very first time. Global brands took only a 3% share led by Sony, Samsung and JBL. Sony led the mid-segment (INR 3,000-INR 5,000) in 2022 with a 37% share.”

Talking about the local manufacturing scenario, Research Analyst Akshay RS said, “In 2022, domestic manufacturing contributed 13% of total shipments, up from just 2% in 2021. With boAt, Mivi and Boult Audio ramping up their local manufacturing capabilities, these brands together accounted for over 75% of the total domestic shipment volume in 2022. Noise, Gizmore, Portronics, Aroma, pTron and Wings also started offering locally produced neckbands in 2022.”

- boAt maintained its lead with a 27% market share driven by its wide range of products in the budget segment, multiple celebrity endorsements and aggressive festive season promotions. The boAt Rockerz 255 Pro Plus was the second most popular neckband in the market and captured a 17% share in the brand’s portfolio. boAt took five spots in the top 10 best-selling neckbands.

- OnePlus maintained its second spot with an 18% market share driven by the growing popularity of the Bullet Wireless Z2 model. Also, the Bullets Wireless Z2 model was the best-selling device in the market and contributed 14% share of the total neckband volume.

- realme took the third spot in the top five neckband brands’ rankings with a 7% market share. The Buds Wireless 2 Neo drove the majority of its shipments followed by the Buds Wireless 2S. Strong channel presence, installed smartphone base and value-for-money offerings were the major factors that pushed its growth.

- Boult Audio grabbed the fourth spot with a 5% share driven by its wider portfolio across price bands. The brand is picking up in the domestic manufacturing space. The Boult Audio Curve model was the brand’s bestseller, capturing a 31% share.

- Ubon rose to the fifth spot with a 3% share. The brand focused on launching more devices in the affordable segment. Almost two-thirds of its volume was driven by online channels.

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.