The Trend is expected to continue driven by the increasing health consciousness

India’s smartwatch market registered its highest ever shipments in Q3 2021 to a record QoQ growth of 159%, according to the latest research from Counterpoint’s IoT service. In YoY terms, the growth was 293%. The growth is attributed to increased health consciousness and to remain fit among the educated population. Smartwatches contributed to around 28% of the total market in terms of shipments.

Mobility Magazine interacted with several top smartwatch providers to get a view of the latest trends in this sector, the reasons for the rise in demand, the challenges & opportunities and future trends.

Rising demand for smartwatches a new phenomenon

Smartwatches which were once deemed as the gadgets used only by the users in the developed countries and only by the elite few in India have now become widely selling accessories in India too. The smartwatches are now a big hit among the youth who want to stay healthy, fit and want to work out. Today, smartwatches form a significant share in the mobile accessories market recording a high YoY growth rate. And this trend is expected to continue for several years to come.

Mr. Paresh Vij, Founder & Director of U&i, “India has the biggest youth population and we target the users in the 13-40 year age group. Today, our youth population has become very health conscious and is paying special attention to fitness and health, particularly after the outbreak pandemic and are relying more on smartwatches to monitor their health parameters.”

Mr. Bharat Seksaria, (Product Head – Mobility), Foxin, “In addition to being health monitoring devices, smartwatches have today become style statements.”

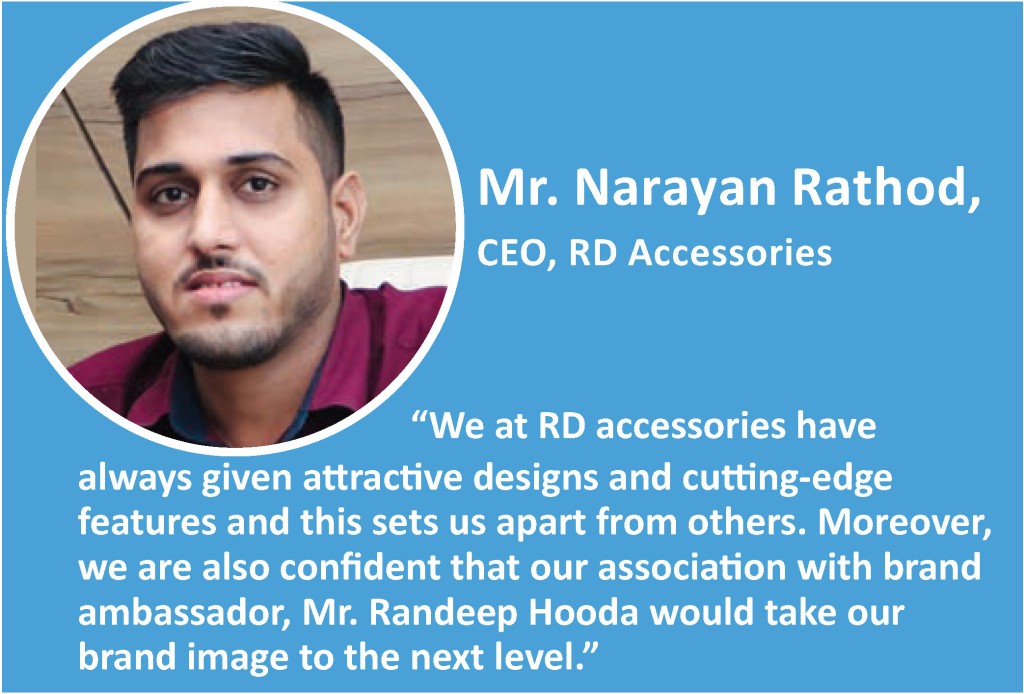

“The health and lifestyle-related elements associated with the smartwatches post-pandemic and the emergence of quality home-grown brands are the biggest drivers in the smartwatch market,” adds Mr. Narayan Rathod, CEO, RD Accessories.

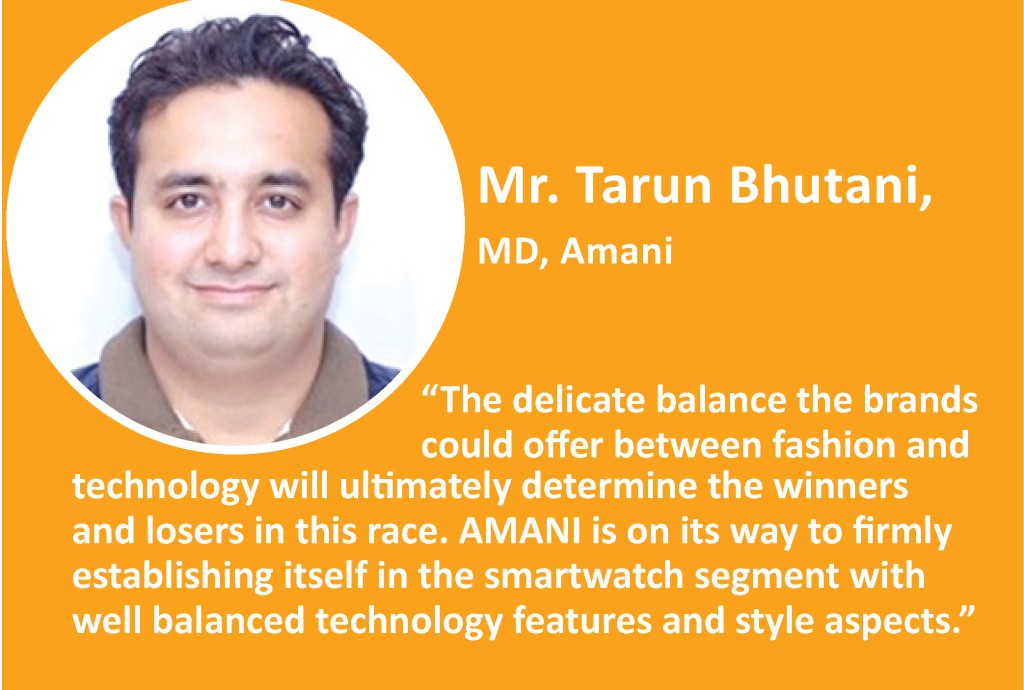

“Consumers are trending toward connected monitoring devices. Not just the time, fashion and other basic features, the sport lovers want to track their short interval workouts and scheduled routines and are pushing the demand up. This trend is expected to ramp up through 2022 and beyond,” thinks Mr. Tarun Bhutani, MD, Armani.

Mr Aayushmaan Wassan, MD, Callmate, “Health tracking and affordability seem to be the driving factors in the smartwatch space. People are keen to monitor their daily activities, calories burnt and their heart-rates during workouts.”

Mr. Sanjay Kalirona, CEO, Gizmore, “In addition to pandemic, another reason for increase in demand is today most Indian brands are offering smartwathes at affordable prices.”

“The demand for smartwatches is seeing a surge due to many first-time users opting for them. Next, wearable makers are adding many new health-monitoring features that appeal to younger as well as to older people,” as per Mr. Lalit Arora, Co- founder, VingaJoy.

Mr. Ritesh Goenka, Group MD, Just Corseca, says, “today, smartwatches have become essential devices among the users as they offers many health monitoring features such as pedometer, oximeter, heartbeat monitor, sleep monitor, blood pressure monitor, ECG monitor, etc.”

“The new technological breakthroughs and multiple health monitoring features, in addition to the ongoing pandemic, have added momentum to the demand of smartwatches. We can expect greater precision in monitoring and data mapping in the future smartwatches,” believes Mr. Archit Agarwal, Co-founder, Crossbeats.

Mr. Achin Gupta, Country Head-India, ZOOOK, “Today, a smartwatch is no longer a mere timepiece, but has evolved into an inseparable companion to most people to monitor their health and fitness, in India as well as abroad.”

Mr. Arnav Kishore, co-founder, Fire-Boltt, “The topmost driver is definitely the pandemic that created a host of health-related apprehensions and awareness.”

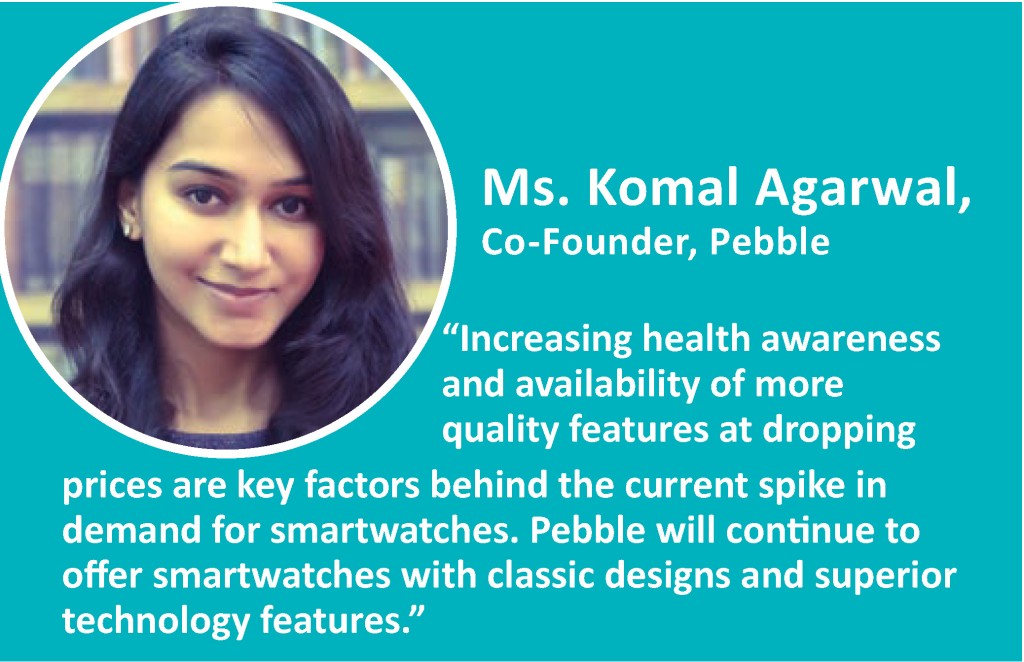

“Besides the awareness triggered by the pandemic, the dropping prices and availability of more quality features are other key factors behind this spike in demand,” states Ms. Komal Agarwal, Co-founder, Pebble.

Mr. Siddharth Gurjar, Director, Minix, “Due to increasing health consciousness, people are increasingly migrating from traditional watches to smartwatches.”

Mr. Anuj Modi, Co-founder, AXL, “In addition to being health monitors, the smartwatches are also becoming style statements.”

Mr. Aashish Kumbhat, Founder & Director, Inbase, “Today, the ease-of-use and regular notifications driven by IoT and Alexa-enabled functions are making these gadgets more attractive.”

“Until recently, smartwatches were luxury items available at substantially higher price points and people used to prefer purchasing new mobile phones for the same price rather than invest on smartwatches. However, today, smartwatches are available at sub-INR 5000 price-points which is attracting more youth with light pockets to purchase smartwatches,” according to Mr. Deepesh Gupta, MD, Molife World.

Mr. Manvendra Chandola, CEO, Riversong, “The ease-of-use and more innovative features in the latest smartwatches are the reasons behind this rise.”

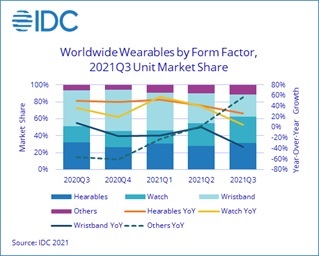

Rapid increase of smartwatches in the overall market share for mobile accessories

Global shipments for wearables grew 9.9% during the third quarter of 2021 (3Q21) reaching 138.4 million units, according to IDC’s Worldwide Quarterly Wearable Device Tracker. Hearables led the growth as the category grew 26.5% compared to the last year and accounted for 64.7% of wearable device shipments. Following the hearables were the wrist-worn wearables often associated with health and fitness tracking, which captured 34.7% of the market.

Although the pandemic has driven interest in health and fitness tracking, wrist-worn wearables such as watches and wristbands faced challenges during the due to the supply constraints and shifting demand brought about by the pandemic.

Mr. Paresh Vij of U&i, “The size of smartwatch market is enormous and is growing.”

“The global smartwatch market was valued at the volume of 68.59 million units in 2020, and it is expected to reach 230.30 million units by 2026, registering a CAGR of 21.98% during the forecast period (2021-2026). According to IDC, the smartwatch market in India grew by 364% in 2021 with 12.2 million shipments as compared to 2.63 million in 2020. In the fourth quarter, the smartwatch vendors shipped 4.9 million units, resulting in a 271% YoY growth in Q4 2021. The Indian watch market is thriving with a sharp rise in adoption due to increasing awareness around health and fitness,” views Mr. Tarun Bhutani of Armani.

Mr. Sanjay Kalirona of Gizmore, “Last year there was around 300% annual growth of smartwatches sales and this growth trend is expected to continue for several more years.”

“Smartwatches have retained their fast growth in the Indian wearables market with 4.3 million annual shipments and a whopping 456% YoY change recorded in the third quarter. The numbers mentioned above show there’s an ample scope in the smartwatch market in India,” asserts Mr. Lalit Arora of VingaJoy.

Mr. Ritesh Goenka, Group Managing Director at Just Corseca, “According to current market trends, the customers are demanding high quality smartwatch with top-notch features in the price range Rs. 3000 to 10,000.”

“Smartwatches have over the last two years retained their position as the fastest growing category in the Indian wearable market. The most interesting part is this growth is driven mostly by homegrown brands. Fire-Boltt is working aggressively to leverage this trend,” comments,” reveals Mr. Arnav Kishore, co-founder, Fire-Boltt.

Mr. Deepesh Gupta, Managing Director, Molife World, “The smartwatch market size currently stands at about 2.5 million units per year in India. As per certain industry estimates, this segment is set to grow by 20%.”

“The market size for smartwathes is too big to be ignored,” asserts Mr. Siddharth Gurjar of Minix.

Mr. Anuj Modi, Co-founder, AXL, “The current demand for smartwatches is about 3-4 lakh units per month.”

“The market share of smartwatches is really huge and is growing,” in the words of Mr. Prashant, Founder, Hapipola.

How the brands want to leverage the opportunities

With the demand for smartwatches rising, many new brands are entering this space creating a cutthroat competition, where quality, features, durability, and price, everything matters. Some brands are focusing on providing smartwatches in the category sub-3K, which is a mass market segment for these devices.

Mr. Paresh Vij of U&i, “We see a huge opportunity in the Tier 2-3 cities for smartwatches. There is immense opportunity as a growing number of consumers want to keep fit and smartwatches are a means to this end.”

“Bluetooth calling and SPO2 are some of the features that are likely to disrupt the market. For the next 10 years, this segment is going to boom,” says Mr. Narayan Rathod of RD Accessories.

Mr Aayushmaan Wassan of CallMate, “The market potential can be comparable to smartphone proliferation in India in the last decade.”

“There is a huge opportunity as the trend of wearing smartwatches is catching up even with Tier 2 and 3 cities. Below 3K smartwatches will drive the demand and volumes in future,” according to Mr. Sanjay Kalirona of Gizmore.

Mr. Lalit Arora of VingaJoy, “Smartwatches are much more than conventional time-tracking devices. Smartwatches can run apps and play back all sorts of digital media, like audio tracks or radio stream to Bluetooth headphones. Improved technology in the smartwatch segment will play a crucial part in future.”

Mr. Deepesh Gupta of Molife World, “A lot of R&D is being done on developing better sensors that monitor various aspects of health including blood sugar, ECG parameters, etc and today smartwatches have become worthy gadgets across all age groups.”

“The feedback and demand we are getting from our channel partners and customers is helping us to constantly work in terms of innovation, quality and design. Shortly, Just Corseca will launch many innovative smartwatches were never seen before in the Indian market. With more practical and innovative designs, Just Corseca is all set to invade the markets,” feels Mr. Ritesh Goenka of Just Corseca.

Mr. Ravi Aggarwal, Director, Cellcor, “People are growing more health & fitness conscious, and are shifting from conventional watches to smartwatches, so there is a huge opportunity for smartwatches in the market

Mr. Achin Gupta of ZOOOK, “From counting steps & calories, tracking sleep, monitoring SPO2 to voice calling, smartwatches have come a long way.”

Mr. Arnav Kishore of Fire-Boltt, “The smartwatches today emerged as an effective way to monitor key health parameters and the opportunities are immense, given the constant innovation in the segment.”

Mr. Siddharth Gurjar of Minix, “There is a lot of opportunity as there are a lot of breakthrough innovations taking place in the smartwatch segment like chat while messaging and IoT-enabled features.”

Mr. Prashant of Hapipola, “New voice command, Google and gaming features, and smartwaches for kids of 5 to 12 years age are likely to disrupt the market.”

“There is definitely a humungous opportunity in this segment. First, there are many people who haven’t yet used smartwatches who are going to be the first-time users, then there are people who want to replace their current smartwatches with the latest ones which is also a potential market, and also there is the segment of smartwatches for kids which needs to be exploited,” avers Mr. Aashish Kumbhat of Inbase.

Mr. Manvendra Chandola of Riversong, “There is scope for new audio features, AMOLED displays, etc in the smartwatches in future.”

Challenges faced by the brands and Make in India manufacturers

As already mentioned, the first challenge is from the intense competition with dozens of brands jumping into the smartwatch segment. The second is competition coming from the grey market where the sellers pay no taxes and could sell them at cheaper prices. The third problem is high import duties and shipment blues. Coming to the manufacturing smartwatches in India, the lack of availability of components locally is a big challenge.

Mr. Paresh Vij of U&i, “We welcome healthy competition that encourages brands to perform better. U&I has always been the first mover and gives the best to customers and innovates according to the needs of customers.”

“We believe that healthy competition will ultimately lead to the improvement in quality and addition of more features in the devices,” believes Mr. Narayan Rathod of RD Accessories.

Mr. Tarun Bhutani of Armani, “The key challenges include migration of users from gadget-like designs to style-conscious designs, lack of manufacturer clarity on use cases and functionality and limited battery life. AMANI will strive to provide smartwatches that have the right balance between fashion and technology features and stay ahead in the competion.”

“Though there are many brands and models, as more and more people are able to identify the reliable products from the clutter, the quality metrics will keep on improving. Callmate has recently launched its smartwatch at a price point of INR 2700,” opines Mr Aayushmaan Wassan of CallMate.

Mr. Sanjay Kalirona of Gizmore, “The first challenge is some brands are pushing low quality products and the second is huge competition in this category driven by online sellers.”

Mr. Ritesh Goenka at Just Corseca, “The smartwatch industry is flourishing as the technology has improved a lot in the recent years. At the same time, the smartwatches, which are currently luxury products, are becoming must-have accessories because they help users with many health features on the go.”

“The biggest challenge is the scarcity of quality raw materials and components when it comes to manufacturing smartwatches in India,” feels Mr. Achin Gupta, Country Head-India, ZOOOK.

Mr. Deepesh Gupta, Managing Director, Molife World, “Smartwatches market is getting much cluttered and over the next few years, and a lot of brands will jump into this segment to take advantage of the growth in this space. The ones which are able to innovate timely and create a brand preference in the market will be the ones who will be able to survive and grow in this segment.”

Mr. Siddharth Gurjar of Minix, “High and growing competition is one of the major challenges in the smartwatch segment.”

“Like in most mobile accessories segments,there is cutthroat competition from branded smartwatches, which is one of the major challenges. Apart from this, there is competition from the grey market smartwatches. Unfortunately, our dependency on China for smartwatches is still quite high. However as the sales volumes grow, we will start manufacturing smartwatches in India. The assembling will shift to local manufacturing,” says Mr. Anuj Modi, Co-founder, AXL.

Mr. Prashant, Founder, Hapipola, “Competition is a big challenge in this segment. The cheap imported products and dupe products in the market are also big challenges.”

“The competition is very intense and the limited availability Made in India products is another big challenge,” states Mr. Manvendra Chandola of Riversong.

Present and future market trends in smartwatch space

The growing trend of people using smartwatches is expected to grow further in the coming years. There will be more AI- and IoT-driven features. Prices are expected to fall further with the increasing number of purchases, mass production and new innovations driving the smartwatch space.

Mr. Ritesh Goenka of Just Corseca, “Nowadays, most smartwatch customers want a larger screen, advanced health-tracking & camera functions, and last but not the least, long battery life. We have been fulfilling the customer requirements by launching products with the features that are in trend. Just Corseca believes in 4 pillars, which we call 4Ds – Discover, Design, Develop and Deliver, that differentiate us from others.”

“Today, smartwatches have become a combination of fashion, utility and health statements. Consumers are adopting smartwatches because of all the above 3 factors. The importance of one over the other may vary from one consumer to the other, but all these factors play a vital role to various degrees when a consumer is making a purchase decision in this segment,” observes Mr. Deepesh Gupta of Molife World.

Mr. Komal Agarwal, Co-founder, Pebble, “Of late, we have seen a shift from the conventional watches to smartwatches amongst the millennials and Gen Z. Pebble smartwatches are positioned as lifestyle products that can help you get the most out of the day and keep your fashion game one notch up. As a brand, Pebble is trying to create an amalgam of classic designs of the analogue watches with the technology of smartwatches.”

“Minix smartwatches have appropriate Amazon listing. The brand endorsements and affordability are the other driving factors for the brand,” Mr. Siddharth Gurjar of Minix.

Mr. Anuj Modi, Co-founder, AXL, “The latest trends are features like monitoring temperature, SpO2, heartrate, and ECG. And the smartwatches in pastel colours is also a current craze in the market.”

Mr. Prashant, Founder, Hapipola, “In 2022, smartwatches will be the style statements, and straps with metal and steel will be the next craze.”

“The voice assistants, AMOLED display watches, battery standby and IoT recording are going to be the new disruptions in the smartwatch segment,” expresses Mr. Aashish Kumbhat, Founder and Director, Inbase.

Strategies the brands follow to gain edge in the competition

The first movers and those who launch smartwatches with more features at affordable prices are likely winners in future. So far, most of the buyers of smartwatches have been from top cities, but now the trend is moving towards, T3 and T4 cities, where consumers are showing increasing interest in smartwatches. The brands that move early into these areas will be have the first-mover advantage.

Mr. Paresh Vij of U&i, “The features that are going to lead will be with healthy heart-beat indicator, touch & feel and calling to name a few. We at U&i are innovative and bring the best to the customers in the first instance. We have been the first movers in any segment and we keep in mind the needs of the customers and the touch and feel part as well apart from giving the best technological innovations. Also we are targeting the Tier 4 cities as well as the demand has percolated to those regions.”

“SPO2, BP monitoring and 24×7 heart-rate tracking are the trends which are going to rule this segment. We at RD accessories have always given attractive designs and cutting-edge features and these set us apart from others. Moreover, we are also confident that our brand ambassador, Mr. Randeep Hooda would help us in creating a very positive image in the market,” claims Mr. Narayan Rathod of RD Accessories.

Mr. Tarun Bhutani of Armani, “Smartwatches aren’t yet quite mainstream gadgets at this point of time. In order to make consumer adopt AMANI’s smartwatches, we are focusing mainly on product quality, seamless advertising and the best-in-class services.”

“A new trend in the smartwatch segment will be IoT-enabled feature. Callmate has positioned itself as a mid-range brand that offers high quality smartwatches. As for promotion, we at Callmate will to focus more on digital marketing,” states Mr Aayushmaan Wassan of CallMate.

Mr. Sanjay Kalirona of Gizmore, “We will be going aggressive on online portals and will be focusing on complete range – from entry to premium segment. We are also focusing on promoting more via digital marketing.”

“Consumers are trending toward connected monitoring devices, spurred by the COVID-19 pandemic, and this trend is expected to continue through 2021. Moreover, the demand for smartwatches is expected to grow by 8% in terms of unit shipments, driven by tech-savvy and fashion-conscious consumers. We’re improvising on the current loopholes in the segment like the low battery life of the watches. Our market strategy is driven by our product quality,” adds Mr. Lalit Arora of VingaJoy.

Mr. Anuj Modi of AXL, “We believe in the word of mouth to reach new customers, and our current customers are our main brand ambassadors. Our aim is to satisfy the customers and for that we have a digital strategy in place to drive forward with ecommerce and strengthen our presence in retail market.”

Mr. Prashant of Hapipola, “We are undertaking digital as well as offline promotion activities to promote our smartwatches.”

“We were one of the first players to launch calling smartwatches. Ever since then, we have a strong hold in this segment with multiple launches. We have built a niche for ourselves by staying in touch with our TG, majorly through online mediums and we have positioned our products as affordable options as compared to the expensive options available in the market. This strategy has helped us sustain and grow,” underscores Mr. Deepesh Gupta of Molife World.

Mr. Archit Agarwal, Co-founder, Crossbeats, “Our market strategy is to target the youth who form the highest income group with good disposable income and are willing to experiment.”

“We are trying to give the best of technological products to the customers. We would come up with new models at affordable prices,” briefs Mr. Aashish Kumbhat, Founder and Director, Inbase,

Ms. Komal Agarwal, Co-founder, Pebble, “A smartwatch is not just a fitness gadget, but a lifestyle & fashion accessory now. Our product marketing strategy is built around this very fact.”

The Innovations likely to dominate the future smartwatches devices

The new innovations that are set to dominate the scene are AI- and IoT-enabled features. The features like SPO2, waterproof & dustproof, step counter, heartrate monitor, etc will continue to be the basic, essential features which are already available in the smartwatches.

Mr. Paresh Vij of U&i, “U&i has always been the first mover / initiator in bringing the technological innovations to its customers. The smartwatch market is likely to be disrupted by remote control, IOT-enabled devices and we plan to bring the technology to the customers at affordable prices.”

Mr. Bharat Seksaria of Foxin, “In future smartwatches, features like blood oxygen level and ECG; superior resolution with AMOLED display and IoT-enabled will be the new trends. Since smartwatches are B2C (customer) products, at Foxin, we are following a multipronged marketing strategy that is a combination of offline and online channels, which include youtube, social media, etc.”

“We plan to pack more smart features into a smaller size option like RD Bluetooth Smartwatch that tracks your workouts, sends notifications and answers your calls. All these packed into a smaller size will give a long battery life. Moreover, the market is likely to be disrupted by IOT-enabled devices which we would also like to incorporate in our smartwatches,” observes Mr. Narayan Rathod of RD Accessories.

Mr. Tarun Bhutani of Armani, Smartwatches with built-in AI technology will rule the markets. In future, after smartphones, smartwatches will become the second most essential gadgets as they monitor the health and fitness.”

“The IoT-enabled devices are likely to disrupt the smartwatch segment and we would continue to bring the best innovative products with this feature in future,” thinks Mr. Aayushmaan Wassan of CallMate.

Mr. Sanjay Kalirona of Gizmore, “We are in the process of developing our own effective Gizmore fitness app with easy-to-use, customer-friendly user interface.”

“We are pushing for AI- & ML-featured products, which make life for consumers easier,” in the words of Mr. Lalit Arora of VingaJoy.

Mr. Ritesh Goenka, Group Managing Director at Just Corseca, “We are a brand that leads in terms of technology. Our smartwatches are making a great impact in the Indian market. Moreover, we are going to launch products with top-notch technology that will become a big hype in the Indian smartwatch market.”

“Regarding the breakthroughs, there are recurrent innovative launches in the market wherein each quality smartwatch has something unique to offer. Smartwatches with more smart features will be the future,” asserts Mr. Achin Gupta, Country Head-India, ZOOOK.

Mr. Arnav Kishore, co-founder, Fire-Boltt, “Regarding major breakthroughs on the way, IoT integration is a definite possibility in near future. For marketing and communication, we work on a strategic roadmap that includes onboarding celebrity brand ambassadors like Virat Kohli and Vicky Kaushal.”

“Our industry is still technologically behind the west and China; hence we still need to evolve to become global trendsetters. As per the current scenario, we are focusing on quality of our products and small innovations that will make our products more useful for customers,” feels Mr. Archit Agarwal, Co-founder, Crossbeats.

Ms. Komal Agarwal, Co-founder, Pebble, “The market for smartwatches is ever-evolving and the latest trend in smartwatches seems to be the increasing demand for high-end AMOLED displays, and accurate health and fitness monitoring features.”

“We are planning to launch AMOLED Display smartwatches by next month. Also, we are planning to manufacture smartwatches soon and how custom duties will be reduced to boost manufacturing,” reveals.

Mr. Anuj Modi, Co-founder, AXL, “We are planning to bring in the latest innovations to the customers.”

“We are working on various aspects, but most of our technological innovations will be centred around superior sensor technology to enable better collection of data related to health parameters and also increase the accuracy of the same,” observes Mr. Deepesh Gupta of Molife World.

Mr. Prashant of Hapipola, “The technological innovations in this segment will be smartwatch with GPS tracking and smartwatches at affordable prices. The opportunities are immense as there are new innovations at every step and in every quarter. New voice commands, Google and gaming features will rule the future smartwatches. Gaming smartwatches for kids in the age group of 5 to 12 years will be the new disruptions in the market.”

To Sum Up

The smartwatches are evolving into essential health monitoring gadgets from being luxury or fancy items as people today are growing more health conscious with Covid as the initial trigger behind this increasing health-consciousness. Today, youth and older generation who want to exercise, workout in gyms and go jogging see smartwatches as convenient and essential devices. AMOLED, IOT-enabled devices in smartwatches are set to disrupt the segment. Smartwatches specially designed for kids and children in the 5-15 age group are expected to be new disruptions in the market. Intense competition between the existing brands, competition from new entrants, challenges from the grey market players and dependency on China-manufactured smartwatches and components still remain big hindrances to brands as well as Make in India manufacturers in India. In such a scenario, identifying hidden opportunities, bringing new technological innovations, improving customer satisfaction and the ability to foresee the upcoming trends can have a profound effect on the overall business performance of smartwatch brands in India. Overall all the major brands see a great potential in the smartwatch segment.

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com , 9811346846/9625243429.