A few research agencies have just released the shipment data for Q1 2022. As mentioned in one of my earlier blogs, conclusions on brand performance based on shipment data for one quarter can be misleading. Market share of brands should be determined by sales by brands and not by shipments brought-in by brands. However, in the absence of the data on sales by brands, one must make do with the shipment data as reported by agencies. If one goes basis the shipment data alone, it is important to see the data of the previous quarter (Q4 2021) and the following quarter (Q2 2022), so that the effect of sales by brands gets reflected in the shipment data.

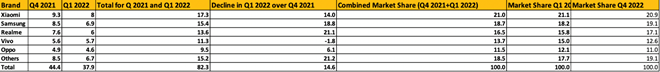

Data is a funny thing. One can find ways of slicing and dicing it to one’s own convenience. If one sees it based on a quarter’s performance, this year over the same quarter performance last year, the findings may favour #Realme strongly as is being shown by Canalys*. However, if one goes based on QoQ comparison – Q1 2022, data over the previous quarter (Q4 2021) and the summation of Q4 2021 and Q1 2022 data the conclusions could be totally different. Here is the illustration based on Canalys data from this perspective.

The decline in shipments of two brands, Realme (21.1%) and #Samsung (18.8%) in Q1 2022 over Q4 2021 is higher than the overall decline in shipment of all brands (14.6%). Oppo has declined the least. Vivo is the only brand to grow.

On the other side, the data being highlighted basis Q1 2022 vis a vis Q1 2021, Realme is the only brand showing a growth.

The combined market share of the market leader #Xiaomi is the same as that of Q1 2022 so actually no loss QoQ. The variation for others is all within 1%.

Some agencies show a decline and some show zero growth in Q1 2022 over the same quarter in 2021. One could blame it on the component shortage but to me it goes beyond that.

Now, moving on to what is expected from the balance part of 2022. Going by the Q1 shipment data, for me, the year has not started off too well for the smartphone industry in India and I am not too optimistic going ahead either. My reasons:

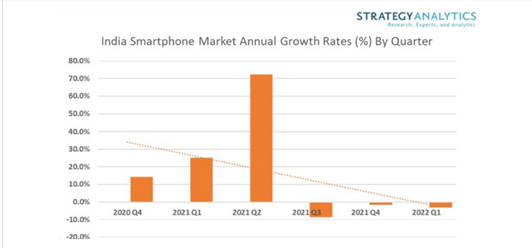

Third consecutive decline:

Q1 2022 is the third successive quarter of decline which makes the QoQ comparison more va mid than the YoY one. Data as per Strategy Analytics below:

Sluggishness in the offline market:

i. The offline retail market is slow and while some people blame it on the heat wave, for me, it goes beyond that. Even if I buy this argument, Q2 should be weak as the heat wave would continue in the months of May and June as well.

ii. Markets across India are now fully open, but the footfalls are weak. As per the reports I have received, distributors are sitting on high stocks of almost all existing models and looking forward to the launches of new models to hopefully drive their business.

The online market is not seeing its glory days too: The eRetail cannot be pushed to buy inventory. To top it up, the low-traction in the online market is making the brands push their stocks to the offline market. Now, the big question is whether they will continue to support offline when the festival season starts in August.

The economic slowdown: While the economic slowdown had not impacted smartphones during the COVID-19 period, the inflation seems to be having an impact on them now. While the ASPs were high last year, the quality of the product justified for it. But, with a lack of innovation this year, most of the customers are holding on to their smartphone, especially in the high-end segment, leaving little scope to the brands to scout for customers in the premium segment.

Hardware specifications are already at levels that exceed normal requirements of customers.

The push by most brands to sell higher-priced devices to offset the equation of higher volume at low prices by lower volumes at higher prices given the component supply issue limiting their TAM (Total Addressable Market).

The supply chain: Rising cases of COVID in China, yet again, has affected the supply side till now followed by the rising cases in India which could become a bigger deterrent in the smartphone demand.

Refurbished devices also affected: While some agencies report increase in refurbished devices, the scenario is exactly the opposite. The availability of used devices in the market has decreased with customers holding on their previous device as a back-up device. Ask the Cashifys of the world and you will know.

For me, all in all, a difficult year ahead for the Indian smartphone industry, unless Jio does a huge market shift in the mass market category which should grow.

So, you ask, what’s the winning formula for brands to keep up to the times to come? Streamline your supply chain. Play in the mid segment and drive volumes. You’ll come out as a winner.

Ajay Sharma, Vice President Flashgard

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.