India’s truly wireless stereo (TWS) market witnessed a record year, shipping 20.3 million units with a healthy 74.7% YoY (year-over-year) growth in 2021.

Factors for the growth

Various factors like hybrid work models, remote work or Work From Home (WFH) and learning new recipes have attributed to the growth of TWS segment.

Domestic manufacturing is gaining more significance and more brand are inclined to partner ODMs to bring made-in-India devices and enhance their production capabilities.

Key findings

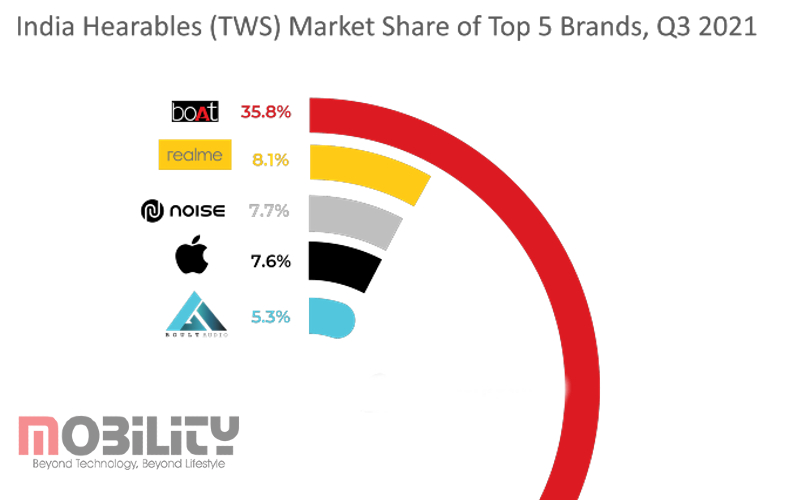

- BoAt and Edict, maintained its position as the market leader capturing 39.3% market share with 187.9% YoY growth in 2021

- Realme retained its second position with a 7.7% share

- (Noise) surpassed Samsung to grab the third position with 7.5% share and 194.7% growth in 2021

Aggressive entry and expansion through the online channel allowed these new-age brands to collectively bring down TWS ASP to $32.8 in 2021, from $43.6 in 2020, resulting in nearly 90% of the TWS category to be below the $50 price band. However, the encouraging reception of new brands viz Nothing, Google, and LG electronics shows consumer enthusiasm in the mid-end segment.

BoAt emerged as the leader with two-fifth of the shipments during the year, which is more than the combined share of the next seven vendors.

The pandemic driven use cases continued to generate the demand for smart audio devices, with tripled shipments YoY in the first half of the year. Festive discounts, competitive pricing, multiple launches and new entrants led to strong adoption in the latter part of the year.

In 2021, the India-based vendors captured over 65% shipments in the TWS category, compared to about half of the market last year.

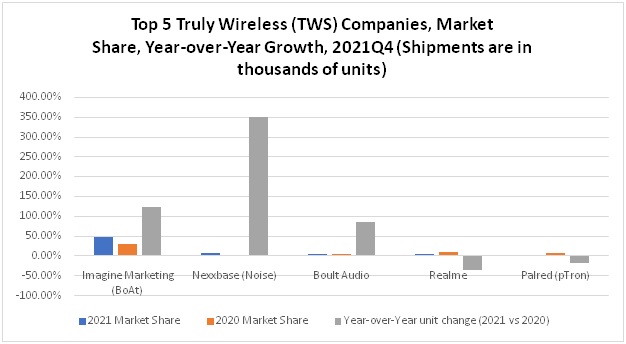

In Q421(Oct-Dec’21), India-based brands cemented their position, with four out of the top five spots. BoAt on its own gave about half of the market volumes, up from 30.1% in the same period a year ago. Noise secured the second position as the fastest growing brand during the quarter with quadrupled shipments YoY.

“Affordability, availability, and appealing aesthetics are the key drivers for the TWS market as a must have complementary device for a smartphone,” says Ekta Mittal, Market Analyst, Client Devices, IDC India. “With increased awareness, consumers will continue to migrate from wired to wireless devices and upgrade to devices with better sound experience, longer battery and comfort,” adds Mittal.

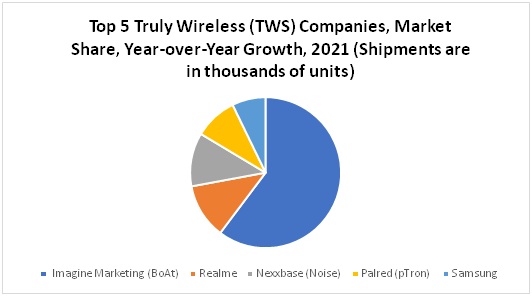

Imagine Marketing (BoAt), which includes shipments from BoAt and Edict, maintained its position as the market leader capturing 39.3% market share with 187.9% YoY growth in 2021. It remained aggressive in its pricing with a wide portfolio. Aggressive digital campaigns, celebrity endorsements, sponsorships, and partnership strategy further supported its dominance.

Realme retained its second position with a 7.7% share, with its leveraged offline ecosystem play and upgraded line-up of Buds Air and Buds Q series.

Nexxbase (Noise) surpassed Samsung to grab the third position with 7.5% share and 194.7% growth in 2021. Refreshed portfolio with improved features and aggressive price corrections aided the brand to gain substantial share.

Palred (pTron) finished fourth with a 6.0% share and 36.8% YoY growth. Onboarding a new celebrity and focusing on devices below $13 price segment became its growth catalyst.

Samsung, which includes devices from Samsung, JBL, Infinity, and Harman Kardon secured the fifth position, witnessing a 23.0% YoY decline with a 4.7% market share.

Commenting on the outlook for the Indian earwear market, Upasana Joshi, Research Manager, IDC India said, “The market is expected to grow multifold in 2022 as India-based vendors will continue to drive the affordability, attempt to reach tier 2 and 3 markets. We will also see new vendors entering the mid to premium end by appealing to users with specific features optimized for Gaming, ANC, etc.”

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.