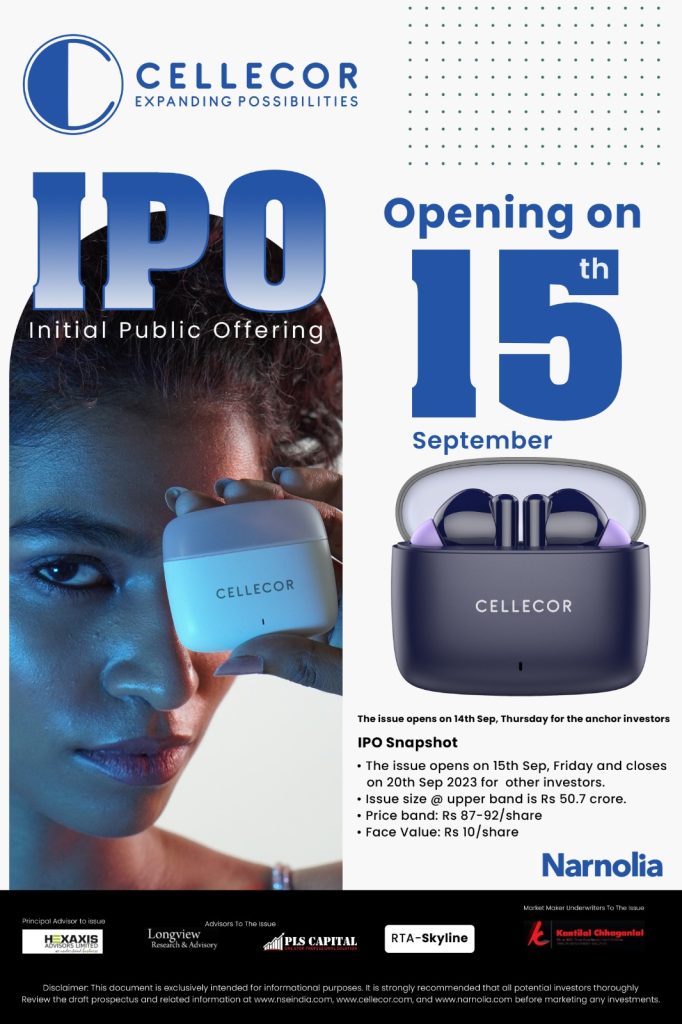

Cellecor Gadgets, an emerging consumer electronics brand, is all set to embark on a new chapter of growth as it announces its initial public offering (IPO). The IPO is scheduled to open for bidding on Friday, September 15, 2023, and will run until Wednesday, September 20, 2023. Cellecor Gadgets will be offering its shares at a fixed price band of Rs. 87-92 per equity share.

We were formerly known as Unity Communications and had a significant 13-year history in the consumer electronics sector. In 2020, we created Cellecor Gadgets, our own FMEG brand. A dynamic company engaged in the procurement, branding, and distribution of a wide range of electronic products, including Smart Televisions, Truly wireless earbuds, smart wearable’s, mobile phones, mobile accessories, and neckbands. The company operates through three distinct business verticals, namely entertainment and communications, peripherals, and modern accessories.

The IPO issue comprises the sale of 55.18 lakh fresh equity shares, each with a face value of Rs 10, totaling Rs. 50.77 crore. The lot size for the IPO is set at 1,200 equity shares, with each lot priced at Rs 1,10,400 at the upper end of the price band. Retail investors are eligible to apply for a single lot, while non-institutional investors have the option to bid for at least two lots.

Mr. Ravi Aggarwal, Founder of Cellecor Gadgets, expressed his enthusiasm for the IPO, stating, “Cellecor Gadgets has embarked on an incredible journey, and this IPO marks a significant milestone in our growth story. We are committed to providing innovative and affordable electronic products to consumers across India. The funds raised through this IPO will enable us to further expand our presence and enhance our offerings in the market.”

The proceeds from the IPO will be channelled towards fulfilling the company’s working capital requirements, general corporate purposes, and covering issue-related expenses. Notably, 2.76 lakh equity shares have been reserved for market maker portions, with SS Corporate Securities and Kantilal Chhaganlal Securities serving as the market makers for the offering.

Cellecor Gadgets boasts an extensive network, comprising more than 1,200 service centers and over 800 distributors. The company’s products are available in over 24,000 retail stores, reaching more than 100 million users across India through both offline and online channels.

To cater to various investor categories, Cellecor Gadgets has allocated 50 percent of the IPO offer to qualified institutional bidders (QIBs), while 15 percent of equity shares are reserved for non-institutional investors. Retail investors will have access to the remaining 35 percent of the offering.

For the fiscal year ending on March 31, 2023, Cellecor Gadgets reported a net profit of Rs 7.97 crore, with a revenue of Rs 264.37 crore. In the preceding fiscal year ending March 2022, the company achieved a net profit of Rs 2.14 crore with revenue from operations totaling Rs 121.29 crore.

Cellecor Gadgets has positioned itself as a leading player in the electronics industry by excelling in contract manufacturing for mobile phones, televisions, sound systems, smart wearables, accessories, power banks, and USB chargers, all marketed under the renowned CELLECOR brand. The company’s IPO price reflects its potential for sustained growth, especially in rural markets, where it has outperformed competitors in grounds.

Mr. Ravi Aggarwal, the promoter of Cellecor Gadgets, brings over a decade of experience in the telecom sector, and the company’s rapid growth over the past three years is a testament to its strategic vision and execution.

Cellecor Gadgets primarily targets Tier 3 and 4 towns and has successfully established a vast distributor network, with over 24,000 retail outlets selling their products. Notably, out of the company’s FY23 revenue of Rs 264 crore, a substantial Rs 256 crore came from offline rural channels, underscoring its strong rural presence.

With a growing online presence on platforms like Amazon and Flipkart, Cellecor Gadgets is poised for further e-commerce expansion. The company’s product portfolio includes mobile phones (47% of revenue), hearables/wearables (23% of revenue), and accessories.

Cellecor Gadgets has positioned itself as a catalyst of India’s rural growth, providing feature phones to customers in smaller towns and cities while being well-prepared to transition to smartphones as the market evolves.

The IPO of Cellecor Gadgets represents a unique opportunity for investors to participate in the company’s journey as it capitalizes on the rising tide of rural India’s growth. The company’s remarkable achievements in just three years make it an exciting prospect for those looking to invest in India’s emerging BHARAT.

Covered By: Mobility India / Cellecor

If you have an interesting Article / Report/case study to share, please get in touch with us at editors@roymediative.com/ roy@roymediative.com, 9811346846/9625243429.