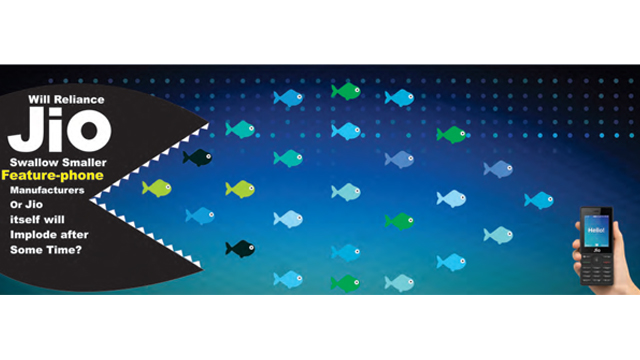

The path-breaking announcement of JioPhone, a 4G feature phone, has taken the market by storm and rattled the feature phone manufacturers, distributors and retailers alike, though smart phone manufacturers are little affected. Many domestic feature phone handset manufacturers feel they cannot survive in the market with Jio selling 4G handsets at such a low price.

Even as the Indian Government is pushing hard its ‘Make in India’ agenda, it has been reduced to a charade in cell phone manufacturing. The ‘Make in India’ initiative has been successful at driving some indigenization in the assembly of mobile phones. Over 120 Mobile Phone brand owners have established their assembly/manufacturing units under the Honorable Prime Minister of India, Shri Narendra Modi’s ‘Make in India’ initiative. Recently, a leading Telecom Service Provider (TSP), Reliance has started providing mobile handsets (JioPhone) along with their service at a very low price-point in clear violation of the principles of fair market competition. Observers feel that Jio’s predatory price of Rs. 501, is practically impossible to compete and consumers will be attracted towards Jio’s offer. This will lead to ‘no demand for Indian made feature phone & mobile devices.’ Just to remind, TSP’s 4G feature phones are not assembled or manufactured in India. Now the question is how the domestic feature phone manufacturers can in particular will survive this onslaught.

JioPhone Monsoon Hungama Offer

However, before rolling out the new device, the company has announced JioPhone Monsoon Hungama Offer is a special offer from Jio in which you can exchange your existing phone for a brand new JioPhone at an effective price of Rs. 501 only. You just need to take your existing phone and charger which should be undamaged and in working condition, to your nearest Jio Retailer and pay Rs. 501 as refundable security deposit. You will also get a special JioPhone Recharge Plan of Unlimited Voice & Data for six months on paying only Rs 594 at the time of activation. Additionally you will also get a special exchange bonus of 6GB data voucher, worth Rs 101. You will get a total of 90 GB data over 6 months. JioPhone comes with a Jio SIM. You may also port-in your existing number via MNP process.

You can exchange any 2G, 3G, 4G (non-VOLTE) phones which is not older than January 1st 2015, to avail this offer. You need to ensure that the existing phone and its charger are both are undamaged and in working condition. Please note JioPhone or any CDMA or operator locked devices WILL NOT be accepted for exchange under this offer.

As part of JioPhone Monsoon Hungama Offer, you need to make an upfront payment of Rs. 501 as refundable security deposit for new JioPhone. You will also get a special JioPhone Recharge Plan of Unlimited Voice & Data for 6 months on paying only Rs 594 at the time of activation. Additionally you will also get a special exchange bonus of 6GB data voucher, worth Rs 101. You will get a total of 90 GB data over 6 months.

How JioPhone is going to affect feature phone manufacturers in India?

The Telecom Services space in India is witnessing cut-throat competition today. The increasing competition between operators has started affecting the mobile handsets industry and its ecosystem where huge investments have already been made. In fact, the handsets being offered represent a clear case of predatory pricing. Offers have been floated by the TSP which is on the verge of announcing to consumers/subscribers, to replace their existing/old feature phones with 4G feature phones at this very low price. The latest unbelievable pricing by Jio has rattled the feature-phone market in India as never before. On the plus side, the offer of Reliance Jio will allow consumers to upgrade to 4G Volte-based feature-phone for just Rs 501 in exchange for any old feature-phone. Jio is one of the largest digital initiatives designed to deliver hi-speed connectivity and 4G broadband services in every nook and corner of India. Now the big question is how will the smaller feature-phone players survive? Will they shut down their plants under the weight of this onslaught?

On the occasion of the maiden launch of Jio in 2015, Mukesh Ambani, CMD of RIL, “India is ranked around 150 in the Internet and mobile broadband penetration out of 230 countries, Jio is determined to change this as 1.3 billion Indians cannot be left behind. It is this opportunity to transform the lives of our 1.3 billion Indians that motivated Reliance to enter this space. Jio will help advance and realize the potential of every Indian. I have no doubt that with the launch of Jio, India’s rank will go up from around 150 to among the top ten in the next few years for internet and mobile broadband penetration.”

Reactions of the Industry Over Jio’s Industry-shaking Offer

JioPhone, the 4G feature phone has been launched at a very tempting price in the Indian market, which many feature phone manufacturers feel as a predatory threat to existing to the existing feature phone manufacturers. Mobility magazine interacted with several players in the feature phone manufacturing industry to know their reactions and outlook.

“This way of providing highly discounted-devices to the consumer is in a way not healthy for the industry. Of course, there is no free lunch so Jio will have to recover the same from consumer in the short- or long-run. In the short run this strategy to convert current feature phone users to Jio may work as there are practically no 4G feature phones available in market from other brands at this price,” comments, Avinash, CLOUT.

“We are ready to fight against this step taken by Jio and it’s totally unethical and due to this smaller brands will suffer losses in terms of money and shut down of factories. This initiative can also throw our lakhs of people out of jobs. This Jio initiative will certainly kill smaller players. The current ecosystem is playing more in favor bigger players; instead the government should understand the facts and do something to protect the smaller players,” shares, by Dev Pareek, SSKY Mobiles.

Manish of Trio feels that the Jio’s announcement is very shocking. The price is unbelievable low, as they are selling nearly at 25% of its cost. This is not an ethical business policy, as it can drive away the smaller players.

Kapil Wadhwa, MD of Champion Mobiles says this is a highly disruptive strategy, but we have to wait and see how it is going to work in the long-run, without jumping to conclusions.

Deepak Kabu. CEO, of Ziox Mobiles, says, “When Jio announced this new launch, obviously all the feature phone brands, including ourselves, were worried, mainly because of the pricing they are offering. But we do not see the impact as much as people are fearing.”

Nikhil Chopra of Megus opines that the initial feeling is worry and found it highly disruptive.

Jovial of POYA MOBILES, says that among mobile phone dealers there is a sense of anxiety about the impact of the Jio launch. Most retailers are also confused as to what to do. In general, the entire mobile manufacturercommunity is shocked over this new development and arewaiting to see how the market will respond.

Shreeman Narayan, CEO, of Indiano says, “We don’t see JioPhone wave as a long-lasting phenomenon. Wait for few months and see; it will no longer be a big deal. Certainly, this type of Jio strategy with utter disregard to smaller players is against business ethics. However, we cannot teach values to every disruptive provider; rather we should always be ready to deal with such short term turbulence.”

Akash Agrawal, Blackbear Technologies Pvt Ltd, says, “Well, when we heard about the Jio plan, it was obviously a news of concern for all of us. We are still weighing how Jio will actually affect the market, but at the same time, we are all ready to face the challenge.”

What the industry foresees the market as the threat of Jio looms?

Most domestic mobile phone manufacturers, particularly the startups and smaller players, feel this predatory pricing by Jio will force them to shut down their plants, where some believe that Jio will not survive in the long-run. Even then how to survive in the short run is a big question for the smaller players. Below are some of the reactions from the smaller players.

“This latest initiative from Reliance launching JioPhone will cause big losses and kill the smaller players besides leading to job losses in the market in a big way. It is a big threat to smaller feature phone manufacturers. Some examples for the effect of this type of invasion by TSPs are, the shutting down of Aircel and Tata, and Idea merging with Vodafone. In my opinion, the process of job losses has already begun,” comments Dev Pareek, SSKY Mobiles.

Manish of Trio asserts, “Yes, this disruptively low-pricing is a huge pressure on the entire mobile handset market and can cause huge losses. We are thinking seriously how to deal with the situation.”

Kannav Thukral of Kara Mobiles says, “Most feature phone handset manufacturers cannot match the prices and service support of Reliance Jio, as Reliance is supported by government. Reliance’s criteria of importing from ASEAN countries and selling goods as services won’t incur any GST and customs duty on their products. This puts all other domestic players at a great disadvantage.”

Nikhil Chopra of Megus asserts, “Certainly, I see lots of bad vibes and panic already. Those people sitting on huge inventories will be the worst-hit and will resort to price war and loss booking. We are more worried about the low price of the Jio handsets and its impact on the survival of players like us.”

Then there are others who feel the Jio’s adventure is only short term. JioPhone can end up in same way as Reliance ended as a CDMA & GSM service provider with big losses.

Shreeman Narayan of Indiano says they do not see Joi initiative as a long-term threat which will certainly shake the market initially, but they are ready to handle such small turbulence.

Kajal Gupta, Sr. Manager, ZICE Mobile, “We are well-prepared for that as well as we have full faith and confidence on our products they too gonna create a milestone in the feature phone industry. We too are having various unique features in our phone and that too at affordable rates and secondly when the question for Make in India arises, we too are making our products in India. And moreover we love healthy competition because it always helps to create and serve something new and epic.”

Yogesh Bhatia, MD, Detel (SG Corp), “In fact, Rs.501 is not the REAL price of Jio handsets; the charge much more than that. The customer has to pay Rs 1100 or 1200 total amount to buy the phone. Yes, there is a lot of panic in the market, but we do not feel any threat from Jio as Detel’s target segment is completely different; we aim to provide connectivity to the 40 crore unconnected customers who are not in 3G or 4G network in T3 and T4 towns thru highly affordable handsets.”

“Definitely Reliance industries is a big operator company in India, but handsets are not their main products. Handsets for them are just supporting products for their data & connect services. Now, Jio wants to disrupt the handset market by crippling the competitors and gain monopoly among the Indian data users. But to achieve this, Jio has already invested a lot hoping big returns in the coming years, and I think after three years the Profit and Loss balance with each other and they can never maintain this low-pricing trend in the long-run. So I feel this type of business adventures do not sustain in the long-run. Just look back at the smartphone that Jio had launched. Its quality did not meet the expectations,” asserts Subir Bose, Partner & Business Head, GIBI.

“First of all, we would like to congratulate Reliance Industries on their initiative. Well, this disruption will definitely affect the Indian Mobile phone industry and it has been proven time and again that whenever a ‘big fish’ takes decision, it affects allthe smaller fishes in the market.The same will be the case this time too. At Blackbear, our team is ready for the upcoming challenges, though it is obviously a tough challenge,” Akash Agrawal, Blackbear Technologies.

Avinash of CLOUT says that any disruptive strategy creates panic for the short term only till the dust settles down. It may lead to losses for domestic players in the short run. It is up to each brand as to how do they handle this short term pressure.

Deepak Kabu of Ziox comments, “Yes, panic is there in the market, but how long the Jio’s game will sustain is more important. Indian market is huge and growing. To sustain in these tough times, all other players must play smart by providing good specs along with the aggressive pricing. So, I don’t feel it is a big threat in the long-run.”

Jovial of Poya says that based on the past experience, they feel that all the retailers and manufacturers know that Jio is a short-term disruption, and things will be back to normal in a short time.

Growth prospects of Fusion / 4G Feature Phones

Jio’s disruptive offer has led to erratic demand for all major handset brands. The smaller players manufacturing with their own SMT lines are facing the maximum heat. Fusion phones (4G feature phones with some smart capabilities) are a now distinct category currently and primarily driven by Jio. Going forward, it is expected that other brands shall also explore Fusion phones and excite the consumers with enriched smart capabilities within the feature phone form factor. Some big brands have already started this on a smaller scale. Let us read what the industry players comment.

Dev Pareek, SSKY Mobiles, feels that the demand and growth of 4G feature phones will continue and gradually lower down the demand for 2G& 3G handsets.

“The disruption created by Jio is important because when someone like Jio brings changes, it will upgrade the market standards and benchmarks.For example, initially there were cordless phones, then came feature phones, then PDAs and then Android phones and tablets, and now 4Gfeature phone… It’s all about upgrading the technologies and we are in that industry where upgrading ourselves and technologies we use, both are equally important. So we believe a step such as taken by Jio will help the general public to move several steps ahead.India has always been a very potential market. Yes, of course, 4G feature phone market has a huge scope, but we believe only one player like Jio playing in the market is not a good trend. We will soon seemore companies investing in 4G feature phone market to break monopoly,” believers Akash Agrawal, Blackbear Technologies Pvt Ltd.

Avinash of CLOUT asserts that growth prospect of 4G feature phones for future is as big as for the current feature phones market and it will also depend on how other operators will play.

Kapil Wadhwa of Champion Mobiles states that all the feature phone users are looking for low-cost solutions and this will help Jio overrun the market.

Deepak Kabu of Ziox comments, “The growth of 4G feature phone is likely to be significant. As per the shipment data of 4G feature phones, it is likely to more than double to 40 million in 2018-19, compared to 18-19 million 4G feature phones shipped in India in 2017-2018.”

Nikhil Chopra of Megus believes, “As far as prospects are concerned, we have to be positive. India is a vast country and is open for lots of new market mappings but what we fear now is if the other operators also follow suit, then the device manufacturing industry will be shaken.”

Jovial of Poya asserts that it is youngsters who are more interested in 4G and they are more interested in smart phones, so we don’t think 4G feature phones will have a long-run in the market.

Do you think Telecom Service Providers will kill Local Feature phone Mobile Manufacturers?

The Mobile Handsets industry expects the government to play a positive role in driving the right policy reforms and offering attractive incentives/tax breaks and a rationalized tariff structure to attract key manufacturers to India. Under the aegis of the ‘Make in India’ mission and trusting the government to provide a stable, rules-based policy environment, mobile makers Like Lava, Micromax, Karbonn, Intex, Jivi and several others have invested hundreds of millions of dollars in Mobile handset assembly/manufacturing units employing over 1,50,000 workers in direct manufacturing job roles.

Avinash of CLOUT states that in the short-run Jio will hamper the trade, but the trick may not work well in the long-run.

Subir Bose of GIBI comments that Jio is not killing the trade but has added a new upward dimension to the feature phone trade.

On the other hand Manish of Trio says the threat that telecoms launching 4G feature phone handsets this way could kill the feature phone manufacturers looms large.

Kapil Wadhwa, Champion Mobiles feels that there is a big threat that the telecom operators could overrun feature phone handset market soon.

Kannav Thukral of Kara Mobiles comments, “The Jio is a huge threat for the handset manufacturing industry. I suggest all handset manufacturers in the industry must come together, support each other and talk to the Govt. about this major concern. Unfortunately, the Govt. is not doing anything so far in this regard; the Govt. should try to protect local smaller and medium manufacturers.”

Dev Pareek of SSKY Mobiles feels Jio is literally killing the spirit of local manufacturers and the government should take decisive steps to protect domestic manufacturers.

What Impact Jio will have on Make in India?

Unfortunately, till date the Government of India has not taken any action on the issue that is likely affect the local mobile phone manufactuers in a bid way. There is no proper law to restrict predatory pricing while the Competition Commission of India (CCI) normally takes a long time to adjudicate on matters. If this malpractice is allowed unchecked, the mobile feature phone manufacturing industry, set up by Indian brands in the face of stiff competition from multinational and Chinese brands will die a premature death.

“While multinational and Chinese smartphone brands like Apple, Samsung, Oppo, Vivo and Xiaomi will not be affected, but feature phone brands like Micromax, Lava, Itel, Intex, Karbonn, Jivi and several others will be forced to shut down feature phones due to the unviability of selling their handsets on market-based sales prices,” Bhupesh Raseen, Chairman-Mobile Advisory Committee, TMA (The Mobile Association)

“Yes, since we are importing all our product as CBU but after the launch of Make in India initiative,we at SSKY Mobiles are assembling in India and providing employment to Indians. But the impact of Jio has already began to shut down factories of other manufacturers, day after day. We are sure that Jio will have a debilitating effect on many Make in India projects,” comments Dev Pareek, SSKY Mobiles.

Akash Agrawal, Blackbear Technologies feels that the telecom industry today is killing manufacturing spirit in India. The govt has to support the domesticindustries, else it will lead to big losses to many of the local manufacturers, besides adding to the army of unemployed.

Shreeman Narayan of Indiano reveals, “Make in India is a great initiative from the government, which in the long-run will certainly help in making our nation industrially strong, though the policy needs a lot of reforms from the government. We are a truly Indian brand based onMake in India concept. Our 100% production is in our factory Noida, India. We have already invested Rs 100 million and are planning to take it up further in future”

“We have already invested heavily in Make in India; we intend to invest around Rs 500 crores more over the next 2 years. More than 50% of our investment is into the production of feature phones in India. We will gradually increase our investment in manufacturing smart phones. I personally believe that Jio’s offer will slow down the rate of users shifting from feature phones to smart phones. This will hamper the sales of feature phone manufacturers at present besides delaying the growth in the sales of smart phones,” asserts Avinash of CLOUT.

Subir Bose, Partner & Business Head, GIBI, feels that Jio is not a threat to Make in India but just a good challenge. One needs to just wait and watch and steady his business strategy according to the market dynamics instead of panicking.

Manish of Trio says that they have set up their manufacturing units and invested quite a sum in plant, machinery and working capital and feels Jio will have a strong negative impact on their manufacturing.

Kapil Wadhwa of Champion Mobiles comments there are over 120 mobile phone manufacturing units set up in India, but the Jio’s initiative will kill most of these units and hardly some 20 units may survive for long.

Deepak Kabu of Ziox asserts, “There are various challenges with which the Indian mobile manufacturers have been struggling. The main challenge is the little cost difference between CBU units and SKD units, which is compelling brands to opt for imports of the CBU. But I feel the govt should work in this regard to promote Make in India more effectively. To promote Make in India, this year, the duties have been imposed on PCBA, camera modules and connectors and the govt is likely to impose more duties by next year. And this can make SKD units more viable. Since we are an Indian brand and we have our own manufacturing based out of Delhi, in which we have invested around Rs 50 cr. Many mobile handset manufacturers and brand owners have established their assembly/manufacturing units in India under the ‘Make in India’ initiative. Allowing sales to DTA/DTZ from SEZs without paying full applicable duty will surely result in wrongful advantage to SEZs and will force closure of domestic manufacturing units who are operating in line with the law duties as imposed by GoI. Jio can add to the already existing troubles of the local manufacturing brands.”

Kannav Thukral of Kara Mobiles states, “We have made big investments under Make in India initiative. When Jio is offering a 4G feature phone handset at Rs 501, who will by a feature phone handset costs Rs 700 to 1000. This can lead to the closure of many handset manufacturing units and lead to big job losses for millions. Obviously, our investments in manufacturing are at a big risk. This can also result in huge revenue losses to the government. Panic is already there and retailers are returning stocks to the distributors. Our workers are also feeling the heat. We need immediate government intervention to save the domestic feature phone manufacturing sector.”

Nikhil Chopra of Megus says, “Many manufacturers in India feel the cost of providing a similar device as of Jio in a profitable way is impossible so this move by Jio will certainly negatively affect the manufacturing spirit. Megus is an upcoming brand and we are planning to shift our production requirements from CBU to SKD in India and take advantage of the new duty structure. But now, we are kept our plans on hold because with Jio in the market, the ‘duty advantage’ will be of no use as the prices people will to pay will not be feasible to us.But in the long-run, I am sure these hiccups will be over and there will be a new balance that will be a Win-Win for everyone.”

Opinion of TSPs and others bout Reliance Jio!

Experts believe that Now government of India must decide whether they would like to save local mobile manufacturers or give too much freedom to TSPs to ruin the entire local feature phone manufacturing. In case the Government wishes to save ‘Make in India’ initiative of Honorable Prime Minister of India, Shri Narendra Modi, then they must restrict not one but all Telecom Service Providers (TSPs) from offering mobile handsets at predatory price-points. This is an urgent measure required to save the Indian Feature Phones and Mobile Handsets industry where thousands of crores of rupees have already been invested over the last four years to develop a world-class Mobile Handset Manufacturing Ecosystem and also where lakhs are employed.

While manufacturers of feature phone handsets are alarmed by the invasion by Jio, the other co-TSPs seem to congratulate Jio, since they are not at all negatively affected.

“We welcome the Reliance Jio’s entry into the digital world and wish them the very best. We also welcome Jio’s call to the leading operators to work together. As a responsible operator, we will fulfill all our regulatory obligations as we have always done. Over the last 20 years, Airtel has been contributing towards building a digitally-enabled India and remains fully committed to and to take leadership in supporting the Government’s Digital India vision. We will continue to innovate and deliver best-in-class products and services to our customers,” said Bhart Airtel on RJIO launch.

Vodafone spokesperson comments, “We always offered great value to our customers, backed by excellent customer service, a nationwide presence and Vodafone SuperNet–our best network ever. We will continue to do so for our hundreds of million customers across the country.”

“Reliance Jio is a valued member of the COAI. We wish to congratulate them on the announcement of the launch of their services. As a valuable member of the association, we welcome them with great warmth and applaud the bold vision of Mr. Mukesh Ambani & the innovation he proposes to bring to the industry. As a thought-leader and the voice of the telecom sector, COAI will continue to advocate fair competitive practices with an enabling policy and regulatory environment which translates into a Win-Win for the industry and the consumer. A stable, predictable, long-term and orderly growth of the industry is essential for a fully connected and digitally empowered India,” comments Rajan S. Mathews, DG, COAI.

At Last

The path-breaking announcement of JioPhone, a 4G feature phone, has taken the market by storm and rattled the feature phone manufacturers, distributors and retailers alike, though smart phone manufacturers are little affected. Many domestic feature phone handset manufacturers feel they cannot survive in the market with Jio selling 4G handsets at such a low price. They also feel that it is a big threat to domestic manufacturing industry which will lead to shutting down of many plants and throwing out millions of people jobless. But some manufacturers are very optimistic that Jio cannot survive in the long run, as they feel that Jio cannot sell at such a low price over a long time. Others feel that most youth are interested in smart phones and few are interested in 4G feature phones so they feel Jio 4G phone is only short-term trend in the market that will fade away with time.

In summary, this development of permitting a TSP to offer smart 4G feature phones at Rs. 501 per unit has the potential to force 100+ Indian mobile manufacturers to shut shop. There is a high possibility that this move may lead to closure of many Indian feature phone manufacturing units and the same will lead to loss of lakhs direct jobs in manufacturing, besides creating huge unemployment down the line in sales and distribution functions. This will also lay waste to huge investments already sunk into acquiring land, plant and machinery, power, water, building roads and warehouses etc. In short, this situation will have a hugely negative impact on the Indian mobile handset manufacturing industry and do lasting damage to the Indian economy.

Jio Phone 2 flash sale

During the first Jio Phone 2 flash sale on Aug.15th, the handset went out of stock soon after it became available. This was rush for the handset was expected as the handset takes over from the popular Jio Phone, whose sales crossed 25 million units in less than a year as per Jio. The Jio Phone 2 price in India stands at Rs. 2,999 and there is no option to avail a refund after 3 years of ownership like there was with the first model. The company says orders placed on the website should be delivered within 5-7 business days. Compared to the original model, the Jio Phone 2’s design is one of the major differentiators between the two phones. The dedicated 4-way navigation keys offer a BlackBerry-style appearance. Even the display is larger and the form factor much wider. Jio Phone 2 next sale will be held on August 30, the company revealed on its official website.

Mr. Mukesh Ambani, CMD of RIL, (commented at the first launch of Jio in 2015)

“India is ranked around 150 in the Internet and mobile broadband penetration out of 230 countries. Jio is determined to change this as 1.3 billion Indians cannot be left behind. I have no doubt that with the launch of Jio, India’s rank will go up from around 150 to among the top ten in the next few years for internet and mobile broadband penetration.”

“India is ranked around 150 in the Internet and mobile broadband penetration out of 230 countries. Jio is determined to change this as 1.3 billion Indians cannot be left behind. I have no doubt that with the launch of Jio, India’s rank will go up from around 150 to among the top ten in the next few years for internet and mobile broadband penetration.”

Mr.Bhupesh Raseen, Chairman-Mobile Advisory Committee, TMA (The Mobile Association)

“Unfortunately, till date the Government of India has not taken any action on the issue that is likely affect the local mobile phone manufacturers in a bid way. There is no proper law to restrict predatory pricing. If this malpractice is allowed unchecked, the mobile feature phone manufacturing industry, set up by Indian brands in the face of stiff competition from multinational and Chinese brands will die a premature death.”

“Unfortunately, till date the Government of India has not taken any action on the issue that is likely affect the local mobile phone manufacturers in a bid way. There is no proper law to restrict predatory pricing. If this malpractice is allowed unchecked, the mobile feature phone manufacturing industry, set up by Indian brands in the face of stiff competition from multinational and Chinese brands will die a premature death.”

Mr.Rajan S. Mathews, DG, COAI

“We welcome and applaud the bold vision of Mr. Mukesh Ambani and the innovation he proposes to bring to the industry. COAI will continue to advocate fair competitive practices with an enabling policy and regulatory environment which translates into a Win-Win for the industry and the consumer,” commented Rajan S. Mathews, DG, COAI

“We welcome and applaud the bold vision of Mr. Mukesh Ambani and the innovation he proposes to bring to the industry. COAI will continue to advocate fair competitive practices with an enabling policy and regulatory environment which translates into a Win-Win for the industry and the consumer,” commented Rajan S. Mathews, DG, COAI

Ms. Kajal Gupta, Sr. Manager, ZICE Mobile

“We are well-prepared and we have full faith and confidence on our products with great features and they too gonna create a milestone in the feature phone industry. Moreover we love healthy competition because it always helps to create and serve something new and epic.”

“We are well-prepared and we have full faith and confidence on our products with great features and they too gonna create a milestone in the feature phone industry. Moreover we love healthy competition because it always helps to create and serve something new and epic.”

Yogesh Bhatia, MD, Detel (SG Corp)

“Yes, there is a lot of panic in the market, but we do not feel any threat from Jio as Detel’s target segment is completely different; we aim to provide connectivity to the 40 crore unconnected customers who are not in 3G or 4G network in T3 and T4 towns thru highly affordable handsets.”

“Yes, there is a lot of panic in the market, but we do not feel any threat from Jio as Detel’s target segment is completely different; we aim to provide connectivity to the 40 crore unconnected customers who are not in 3G or 4G network in T3 and T4 towns thru highly affordable handsets.”

Mr. Dev Pareek, SSKY Mobiles

“Jio’s step is totally unethical which will result in smaller brands suffering financial losses, youth losing jobs and factories shutting down. Presently the system is playing more in favor bigger players. The government should understand the facts and do something to protect the smaller players.”

“Jio’s step is totally unethical which will result in smaller brands suffering financial losses, youth losing jobs and factories shutting down. Presently the system is playing more in favor bigger players. The government should understand the facts and do something to protect the smaller players.”

Mr. Akash Agrawal, Blackbear Technologies Pvt Ltd.

“Disruption created by Jio will upgrade the market standards and benchmarks. Though 4G feature phone market has a huge scope, only one player like Jio playing in the market is not a good trend.”

“Disruption created by Jio will upgrade the market standards and benchmarks. Though 4G feature phone market has a huge scope, only one player like Jio playing in the market is not a good trend.”

Mr. Kannav Thukral, Kara Mobiles

“We have made big investments under Make in India initiative, but the fact is the Reliance Jio can destroy the domestic feature phone manufacturing industry in India. Panic is already there and retailers are returning stocks to the distributors. We need govt’s intervention to save the domestic feature phone manufacturing sector.”

“We have made big investments under Make in India initiative, but the fact is the Reliance Jio can destroy the domestic feature phone manufacturing industry in India. Panic is already there and retailers are returning stocks to the distributors. We need govt’s intervention to save the domestic feature phone manufacturing sector.”

Mr. Avinash, CLOUT

“There is nothing called free lunch so Jio will have to recover the expenses from consumer in the short- or long-run. In the short run Joi’s strategy may work. Each brand should learn how to handle this short term pressure.”

“There is nothing called free lunch so Jio will have to recover the expenses from consumer in the short- or long-run. In the short run Joi’s strategy may work. Each brand should learn how to handle this short term pressure.”

Mr. Subir Bose, Partner & Business Head, GIBI

“Jio wants to gain monopoly in the feature phone handset market by crippling the competitors. Jio has already invested a lot hoping big returns in the coming years, and I think after some time the Profit and Loss balance with each other and they cannot maintain this low-pricing in the long-run.”

“Jio wants to gain monopoly in the feature phone handset market by crippling the competitors. Jio has already invested a lot hoping big returns in the coming years, and I think after some time the Profit and Loss balance with each other and they cannot maintain this low-pricing in the long-run.”

Mr. Kapil Wadhwa, Champion Mobiles

“We see a big threat from the telecom operators like Jio who could overrun feature phone handset market soon.”

“We see a big threat from the telecom operators like Jio who could overrun feature phone handset market soon.”

Mr. Shreeman Narayan, Indiano

“At Indiano, we are very happy to hear the Jio announcement and we believe this is going to help customers by providing them better technology at lower prices.”

“At Indiano, we are very happy to hear the Jio announcement and we believe this is going to help customers by providing them better technology at lower prices.”

Mr. Manish, Trio

“Jio’s announcement is very shocking. The price is unbelievable low, selling nearly 25% of the cost. This is not an ethical business policy as it can drive away the smaller players.”

“Jio’s announcement is very shocking. The price is unbelievable low, selling nearly 25% of the cost. This is not an ethical business policy as it can drive away the smaller players.”

Mr. Nikhil Chopra of Megus

“Certainly, I see lots of bad vibes and panic already. Those people sitting on huge inventories will be the worst-hit and will resort to price war and loss booking. We are more worried about the low price of the Jio handsets and its impact on the survival of players like us.”

“Certainly, I see lots of bad vibes and panic already. Those people sitting on huge inventories will be the worst-hit and will resort to price war and loss booking. We are more worried about the low price of the Jio handsets and its impact on the survival of players like us.”

Mr. Deepak Kabu, Ziox

“Panic is there in the market, but how long the Jio’s game will sustain is more important. To survive in these tough times, all other players must play smart by providing good specs along with aggressive pricing. I don’t feel Jio is a big threat in the long-run.”

“Panic is there in the market, but how long the Jio’s game will sustain is more important. To survive in these tough times, all other players must play smart by providing good specs along with aggressive pricing. I don’t feel Jio is a big threat in the long-run.”

Mr. Jovial, Poya

“We sense that most dealers and retailers look anxious and confused about the impact of the Jio launch. In general, the entire mobile manufacturer community is shocked over this new development and is waiting to see how the market will respond and realign.”

“We sense that most dealers and retailers look anxious and confused about the impact of the Jio launch. In general, the entire mobile manufacturer community is shocked over this new development and is waiting to see how the market will respond and realign.”